- #Payroll intuit online login update

- #Payroll intuit online login password

- #Payroll intuit online login free

Go to the Gear icon, then select Feedback.Once approved, they can incorporate it in the next release. All requests will be reviewed by our Product Development Team. I recommend that you give feedback through your QBO account. This is also an excellent addition to future product development. I've included a link to help you: Export your reports to Excel from QuickBooks Online. If you wish to use different classifications for specific employees, you can follow the procedures described by my colleague jamespaul above.Īlternatively, you can export your report to Excel and manually assign classes there to keep control of your employees' time. The classifications on the timesheets are different from the paychecks. This is why it appears as unclassified on the Profit & Loss report when used on the payroll. Currently, the designated class on the timesheet is allocated for the customer or vendor transaction. I know it will make it easier for you to track your employees if the assigned class for their timesheet appears on the report. I understand the situation you're in, Ryoungster99. You're also welcome to add any other concerns about your entries or tax forms.

#Payroll intuit online login free

I'll also include this article if you need to check and verify your current liabilities for the quarter: Run payroll reports.įeel free to drop by again if you have questions about running your reports or managing the paychecks. Create and manage classes in QuickBooks Online.Set up and track your payroll expenses by class.I'm sharing a couple of these articles if you need help with the Class tracking feature: Check the data on the Profit and Loss By Class report to determine the dates for the unclassified paychecks.

#Payroll intuit online login update

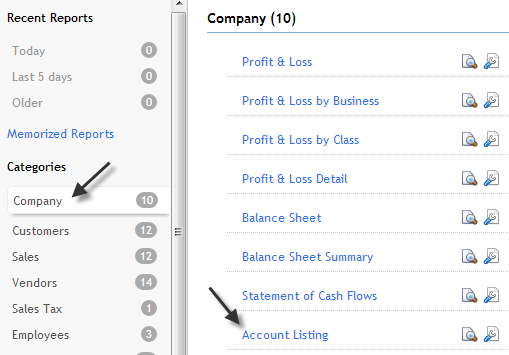

On the Accounting Preferences page, click the pencil icon on the Update existing transactions section. If you want to add the classes to the previous paychecks, we can do so by using the Update existing transactions function. Tick I use different classes for different employees.Click the Pencil icon on the Class tracking section.Scroll down to the Accounting section, then click the Pencil icon.Click the Gear icon, then select Payroll settings.This way, when you run the Profit and Loss by Class report, your paychecks won't show up under the unclassified column. So, we'll want to enable this option from the Payroll settings page. Paychecks have a different and separate Class tracking system. After running payroll, the classes won't link with the paychecks as you've noticed. The classes coded on the timesheets are separate from the paychecks. Click Preferences and set up email notifications.I'm dropping by to share some details about why the coded classes won't show up on the Profit and Loss by Class report.

Get a printed version (PDF) of these instructions.

#Payroll intuit online login password

They'll be asked to provide an email address, a password, and a security question and answer, in case they need to recover their password later.

An Intuit account allows employees to access multiple sites and products with one user ID and password. We'll need this to verify who they are and match them with the correct company and paycheck info.Īnd here's what employees need to do to sign up:

If they don't have their last paycheck, they may ask you to provide that info.

0 kommentar(er)

0 kommentar(er)